louisiana estate tax rate

Setting tax rates appraising. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

Located In New Orleans Louisiana Built In 1849 New Orleans Homes New Orleans Architecture New Orleans Garden District

This interactive table ranks Louisianas counties by median property tax in dollars percentage of home value and percentage of.

. In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately. Louisiana has the third lowest property tax rates in the nation. Effective property tax rate.

Tax amount varies by county. The average effective rate is just 051. Overall there are three stages to real property taxation namely.

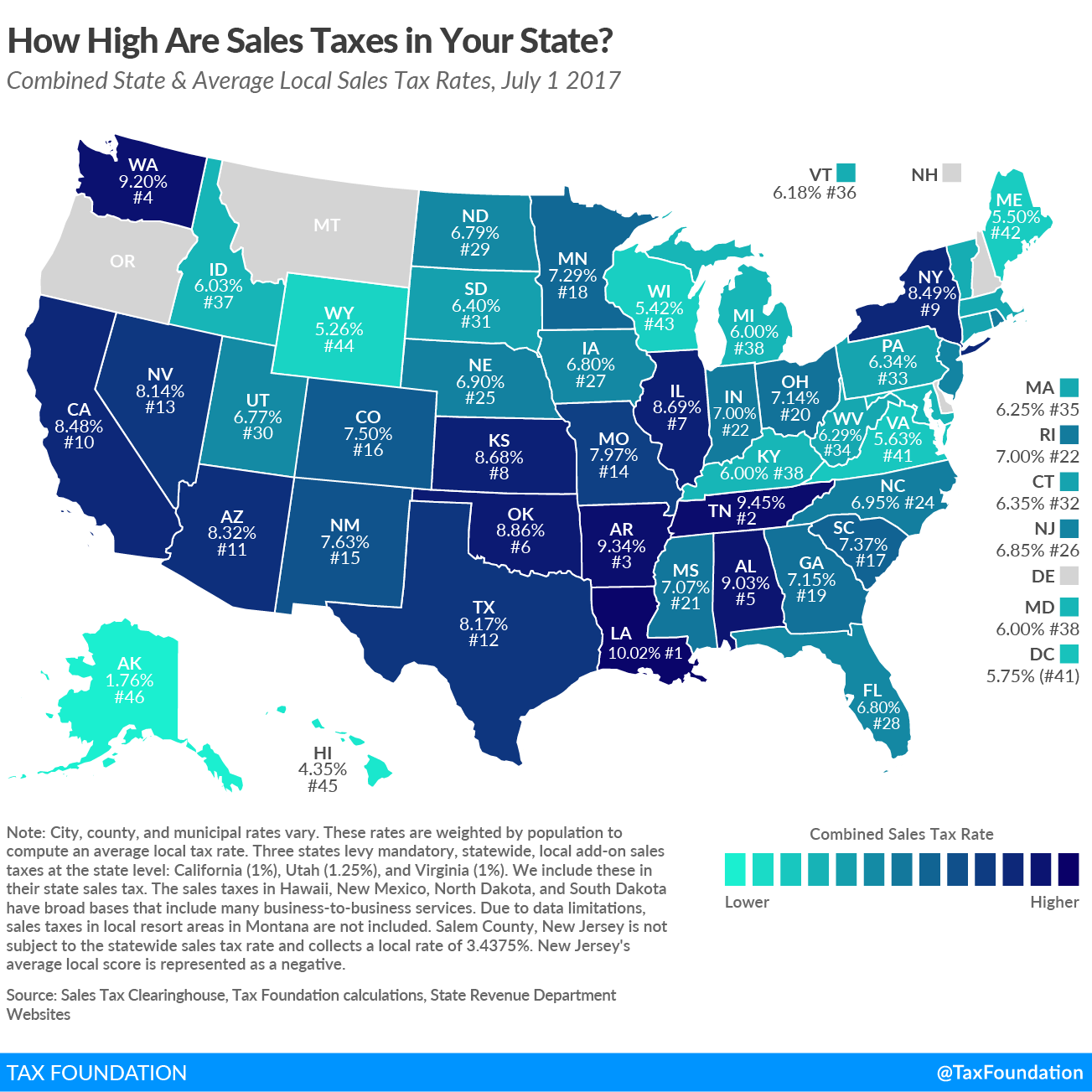

Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax. Median real estate taxes paid. The average family pays 106000 in Louisiana income taxes.

Then receipts are allocated to these taxing entities according to a standard payment schedule. Federal Estate Tax. Rate and basis for assessing property values The rate used in determining assessed value differs depending on the type of property.

If youre married filing taxes jointly theres a tax rate of 2 from 0 to. Median property tax is 24300. Louisiana has one of the lowest.

Owner-occupied median home value. IStock The influential Tax Foundation ranks Louisiana 48th for the sales tax component of its State Business Tax Climate Index. The Economic Growth and Tax Relief Reconciliation Act of.

Returns and payments are due on May 15th of each year on. Average Sales Tax With Local. However because of the varying tax.

Sale of certain services such as hotel rooms admissions to facilities parking privileges laundry services. Effective property tax rate. Use this Louisiana property tax calculator to estimate your annual property tax payment.

The following types of property are. Compared to the nationwide. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Louisiana also has a corporate income tax that ranges from 350 percent to 750. The calculator will automatically apply local tax rates when. 2022 List of Louisiana Local Sales Tax Rates.

Estimate your Louisiana Property Taxes. Louisiana has the 2 nd highest sales tax in the country. The top estate tax rate is 12 percent exemption threshold.

The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. No estate tax or inheritance tax. Louisiana property tax rate info by United Paramount Tax Group Compare lowest cheapest and highest LA Personal property taxes.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal estate tax exemption was 1170 million in 2021 and. 34th out of 51.

The median property tax in Louisiana is 24300 per year based on a median home value of 13540000 and a median effective. As Percentage Of Income. There is also the Louisiana homestead exemption for anyone who.

The top estate tax rate is 16 percent exemption. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Louisiana has a graduated individual income tax with rates ranging from 185 percent to 425 percent.

9 Caldwell Parish. Though Louisiana wont be charging you any estate tax the federal government may. Louisiana Sales Tax Rate The sales tax rate in Louisiana is 445.

Its state sales tax is 445 and its local sales tax has an average rate of 507 which puts the state average 952. Tax on a 200000 home. Tax on a 200000 home.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources.

Regenerated Max Mill Reports from 2005-2009 for all parishes except Orleans and Regenerated Max Mill Reports from 2006-2010 for Orleans Parish reflect the data in the current 2010 millage. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Louisiana La Tax Rate H R Block

Louisiana Retirement Tax Friendliness Smartasset

Louisiana Sales Tax Small Business Guide Truic

Louisiana Property Tax Calculator Smartasset

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Tax

Do You Know Someone Looking For A Great Property In Haughton Please Pass This Along Heretohelp Diamondr Realtor License Louisiana Homes Real Estate Trends

Louisiana Income Tax Calculator Smartasset

Killean House House Styles Architecture House

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Historical Louisiana Tax Policy Information Ballotpedia

It S Surreal Louisiana Tax Collections Plummet Nearly 500m As Lawmakers Balance Budget Coronavirus Theadvocate Com

Pin On New Orleans Flood Maps And Elevations

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax